Distractions vs. Details

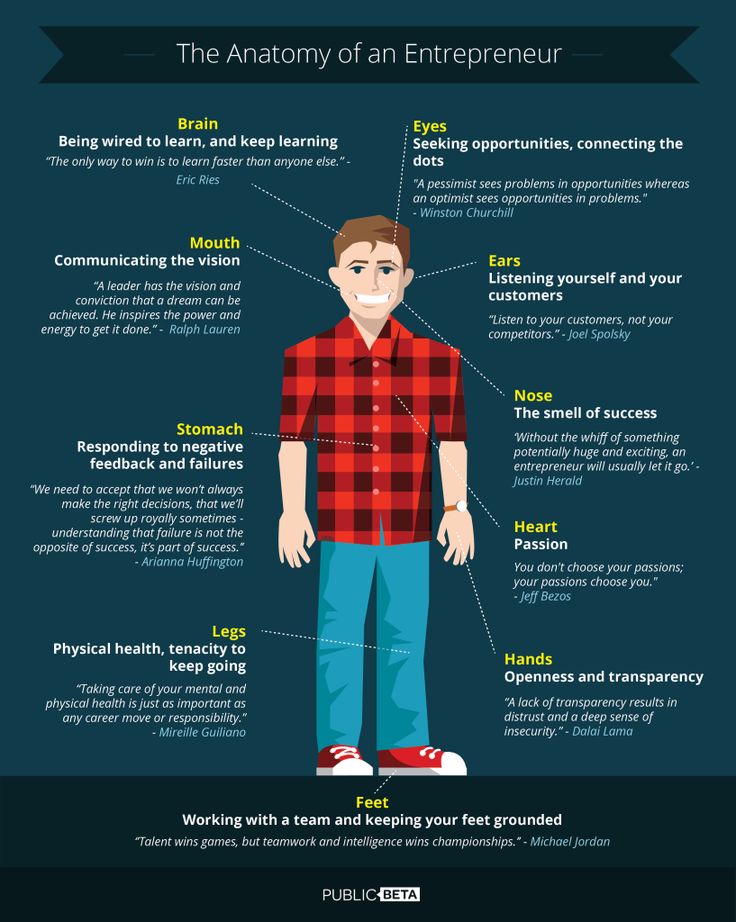

The latest from Mark Suster on Both Sides of the Table really got me thinking about the anatomy of a successful entrepreneur (founder, executive, etc.) vs. a successful VC (or investor or angel). There are some skills that are inherent for each.

Suster's blog explains that successful executive typically benefit from the ability to avoid "shiny objects." In a super complex full of omnipresent distractions, great entrepreneurs and founders and makers will filter the minutia and external stimuli like this:

The important detail here is that the most successful business owners always have at least one eye on the prize. They're ready to dedicate whatever attention necessary to close the deal. They don't spend

The great thing here is that incentives are aligned. Above all else, VCs want a wildly successful exit, so if both parties are defining "success" in the same way, the potential for synergies is unlimited. However, if an entrepreneur doesn't define "success" as some exit opportunity, it's likely there will be some friction.

The Venture Capitalist

Innovation is changing the dynamics of this relationship. Investor Li Jang from GSV Capital says the power has shifted to "founders versus VCs as more entrepreneurs gain access to tools to build companies at lower costs. Alternative sources have also democratized access to capital so that VCs are no longer the gatekeepers to funding (translation: more innovation)."

There are still key differences in the way each party approaches their roles. Put another way, author Ray Edwards says in his blog,

"The difference between entrepreneur and investor is an important one…

Entrepreneur: someone who works their tail off, risks everything, and either makes a bloody fortune or goes bankrupt.

Investor: someone who takes a calculated risk, with capital they can afford to lose, in exchange for an enormous potential payoff… and who does virtually none of the work."

Now, whether you, like Edwards, believe that the VC does none of the work, we can agree successful and agile VCs and founding executive have to constantly be reinventing themselves.

The Entrepreneur

|

| Infographic: Inc42 |

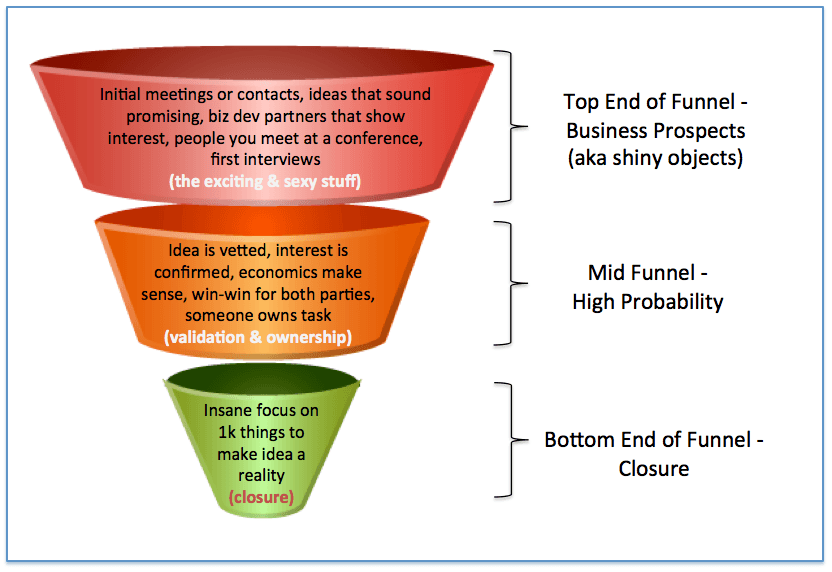

Suster's blog explains that successful executive typically benefit from the ability to avoid "shiny objects." In a super complex full of omnipresent distractions, great entrepreneurs and founders and makers will filter the minutia and external stimuli like this:

|

| Graphic: Mark Suster, Both Sides of the Table |

The important detail here is that the most successful business owners always have at least one eye on the prize. They're ready to dedicate whatever attention necessary to close the deal. They don't spend

The great thing here is that incentives are aligned. Above all else, VCs want a wildly successful exit, so if both parties are defining "success" in the same way, the potential for synergies is unlimited. However, if an entrepreneur doesn't define "success" as some exit opportunity, it's likely there will be some friction.

The Venture Capitalist

|

| Meme: Medium |

The primary function of the successful investor is all in the details. It's all about the networking and the names. This is important for entrepreneurs as well, of course, but this is the lifeblood of a VC. They are concerned primarily with all of the "shiny objects" and prospects at the top of the funnel that could potentially turn into home runs. Details are a necessary evil and a key ingredient in the triumph of VCs. They can quickly filter through the distractions to find the elements that might lead to a win.

Innovation is changing the dynamics of this relationship. Investor Li Jang from GSV Capital says the power has shifted to "founders versus VCs as more entrepreneurs gain access to tools to build companies at lower costs. Alternative sources have also democratized access to capital so that VCs are no longer the gatekeepers to funding (translation: more innovation)."

There are still key differences in the way each party approaches their roles. Put another way, author Ray Edwards says in his blog,

"The difference between entrepreneur and investor is an important one…

Entrepreneur: someone who works their tail off, risks everything, and either makes a bloody fortune or goes bankrupt.

Investor: someone who takes a calculated risk, with capital they can afford to lose, in exchange for an enormous potential payoff… and who does virtually none of the work."

Now, whether you, like Edwards, believe that the VC does none of the work, we can agree successful and agile VCs and founding executive have to constantly be reinventing themselves.

Comments

Post a Comment